OUR INSIGHTS

The Data Sense Blog

Exploring the world of data automation, analytics, and strategic insights for businesses and organizations.

-

22 minutes

How to Create and Validate Synthetic Financial Data in Python

Read Featured Article ->: How to Create and Validate Synthetic Financial Data in PythonRecently Data Sense published an article discussing how synthetic financial data is reshaping risk management in financial services. We detailed how financial regulators have begun to experiment and publish guidelines for implementing and assessing synthetic data for analytical fidelity and privacy preservation. But how can this actually be achieved? Extending our previous research, we have…

MORE INSIGHTS

Explore Our Latest Articles

-

9 minutes

9 minutesCreating an Ironman Training Dashboard with Google Antigravity

Read More ->: Creating an Ironman Training Dashboard with Google AntigravityBuilding a custom analytics dashboard usually means days of boilerplate: app scaffolding, callbacks, layout wiring, and database plumbing. All of that happens before you can even ask whether the dashboard is answering the right questions. This post walks through a small experiment: how far I could get building an Ironman…

-

4 minutes

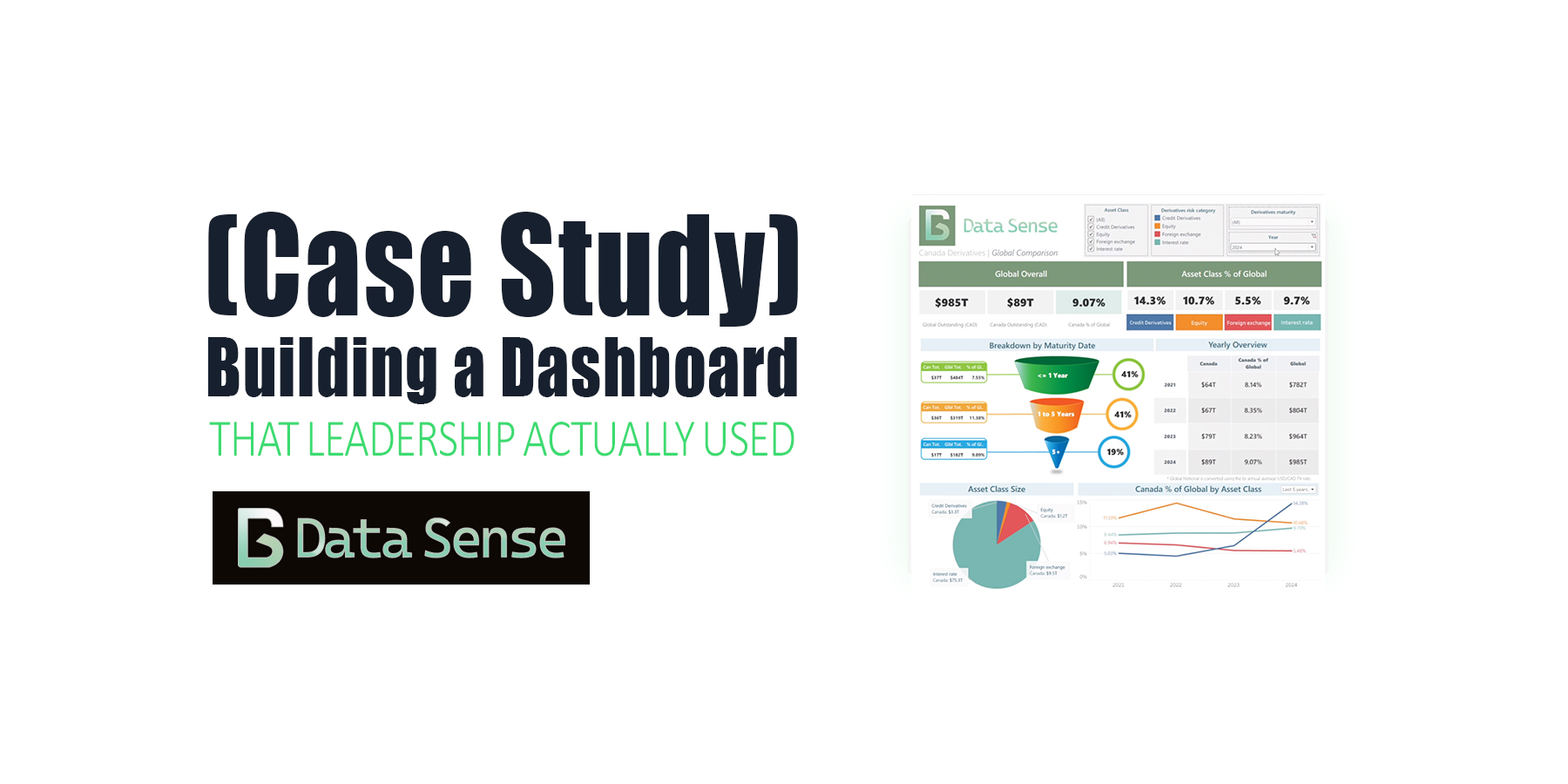

4 minutesBuilding a Dashboard That Leadership Actually Used (Case Study)

Read More ->: Building a Dashboard That Leadership Actually Used (Case Study)A case study on a global derivatives dashboard. What started as a simple Tableau build ended up shaping future ETL automation, data scraping pipelines, and dashboards for years.

-

5 minutes

5 minutesHow to Get Hired as a Financial Data Analyst with AI (2025)

Read More ->: How to Get Hired as a Financial Data Analyst with AI (2025)AI isn’t taking financial data analysts jobs, it’s changing the definition of them. In modern finance, the analyst’s role is evolving from reporting the past to predicting the future. Those who can harness AI-driven insights, automate workflows, and communicate results clearly are redefining what “analysis” means in the age of…

-

4 minutes

4 minutesTop 5 Power BI Dashboard Tips to Improve Your Reports Today

Read More ->: Top 5 Power BI Dashboard Tips to Improve Your Reports TodayPower BI has helped democratize dashboards by giving anyone, from aspiring data analysts to business managers, the tools to explore, visualize, and share insights. Building a Power BI dashboard that looks good is easy, but building one that actually works takes intention. In our last article, we looked at why…

-

11 minutes

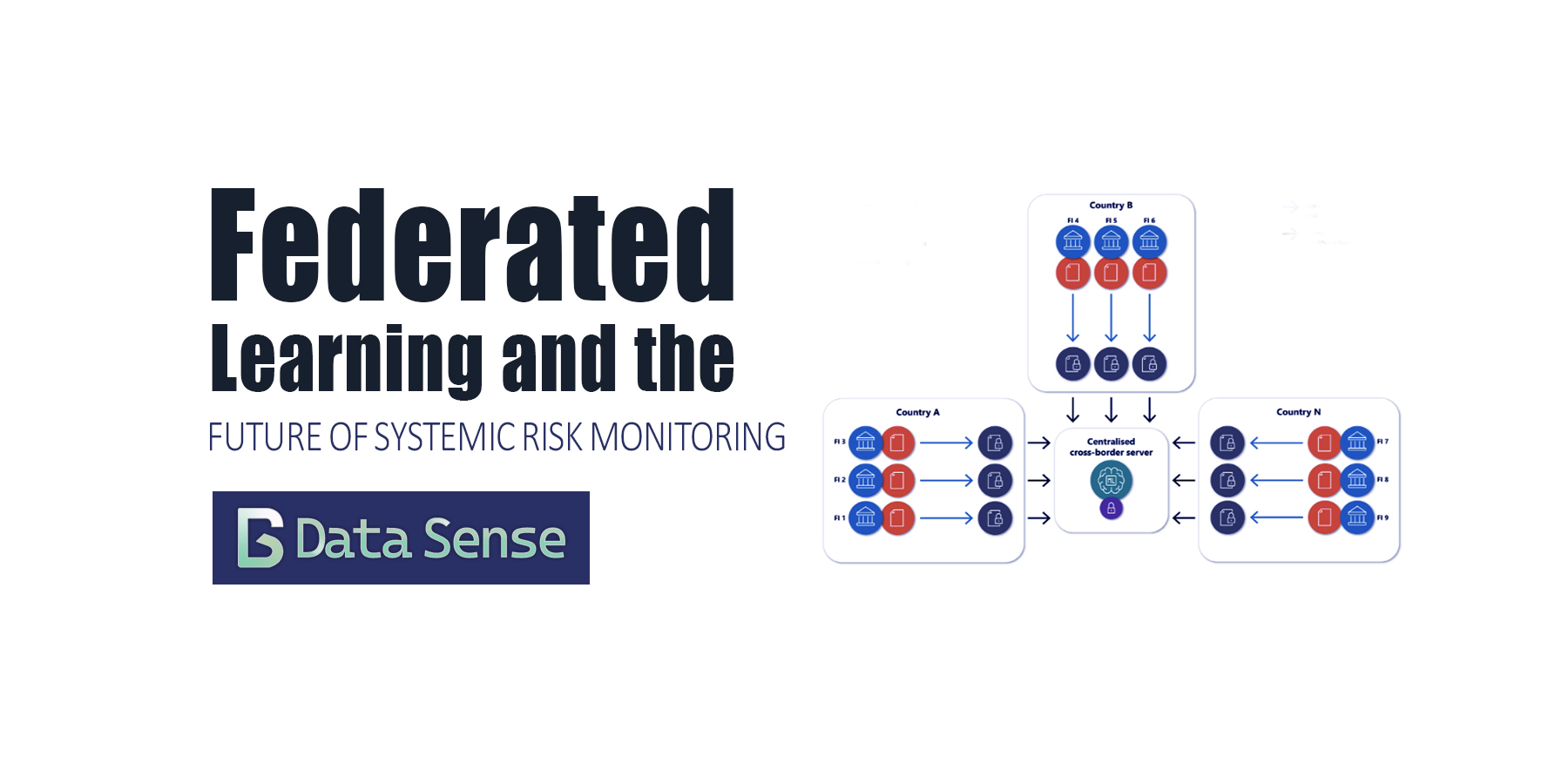

11 minutesFederated Learning and the Future of Systemic Risk Monitoring

Read More ->: Federated Learning and the Future of Systemic Risk MonitoringCross-border financial data remains fragmented, siloed, and difficult to use for proactive risk oversight. With new privacy, AI, and governance rules tightening globally, collaboration between financial institutions has become both necessary and technically complex. Federated learning is a promising framework for overcoming these challenges.

-

5 minutes

5 minutesWhy Most Power BI Dashboards Fail (5 Simple Fixes)

Read More ->: Why Most Power BI Dashboards Fail (5 Simple Fixes)Power BI has helped democratize dashboard creation by giving anyone, from sales aspiring data analysts to sales managers all the tools to build a great dashboard. Sadly, most of these dashboards end up in a folder somewhere, never getting the attention they deserve. Sometimes the issue is design; cluttered layouts,…

-

8 minutes

8 minutesDashboard Design Best Practices: From Charts to Clarity

Read More ->: Dashboard Design Best Practices: From Charts to ClarityOver the past few years, dashboards have become ubiquitous. Thanks to the “democratization of data visualization tools,” everyone is suddenly an analyst. With drag-and-drop interfaces and endless templates, it’s never been easier to pull data into a dashboard and share it with colleagues or executives. The problem? Most dashboards are bad.…

-

17 minutes

17 minutesProgrammable Finance on DLT: Data-Centric Perspective

Read More ->: Programmable Finance on DLT: Data-Centric PerspectiveIn this weeks article we discuss how distributed ledgers reshape settlement data, risk metrics, and privacy controls in financial markets. The rise of programmable finance on DLT is reshaping how financial institutions think about settlement, data governance, privacy, and risk. Unlike earlier blockchain hype, today’s experiments focus on the data…

-

8 minutes

8 minutesThe Democratization of Data Visualization: Lessons from Plotly

Read More ->: The Democratization of Data Visualization: Lessons from PlotlyFor decades, data visualization was the guarded domain of BI specialists, statisticians, and data analysts. If an executive wanted a dashboard or a policymaker needed an analysis, they had to request it through a central analytics team and wait days or weeks for results. That world is gone. Today, thanks…

-

10 minutes

10 minutesSynthetic Data in Financial Services: Reshaping Risk

Read More ->: Synthetic Data in Financial Services: Reshaping RiskAs synthetic data in financial services gains momentum, evidence from the Financial Conduct Authority (FCA), the European Commission (EC), and central-bank forums shows it can help close cross-border visibility gaps in risk monitoring and systemic oversight When Lehman Brothers collapsed in September 2008, supervisors around the world struggled to see how risks…

What are you interested in?

©2025 Data Sense. All rights reserved.