AI isn’t taking financial data analysts jobs, it’s changing the definition of them. In modern finance, the analyst’s role is evolving from reporting the past to predicting the future. Those who can harness AI-driven insights, automate workflows, and communicate results clearly are redefining what “analysis” means in the age of intelligent automation.

For financial data analysts and data scientists, this shift brings new questions: Which skills are still essential? Which tools are becoming obsolete? And how do you stand out in a market where AI can write code, generate dashboards, and even summarize 10-Ks?

This guide unpacks what the data and employers are saying, with practical insights on where the jobs are, which skills are most in demand, and how to upskill effectively to future-proof your career in finance and analytics.

Job Market Snapshot (Late 2025)

Indeed currently lists over 500 “Financial Data Analyst” roles in New York and more than 1,000 “Data Analyst” roles across sectors. Similar trends are observed globally with steady hiring across banking, fintech, consulting, and government.

Typical responsibilities include querying financial databases, building dashboards (Power BI, Tableau), conducting forecasting and performance tracking, and designing risk or fraud analytics frameworks.

In the U.S., the median total pay for a Financial Data Analyst is around $99,000, while general Data Analysts average $92,000, according to Glassdoor. Despite automation concerns, most firms are hiring more data-literate analysts — not fewer — as AI tools amplify rather than replace analytical capacity.

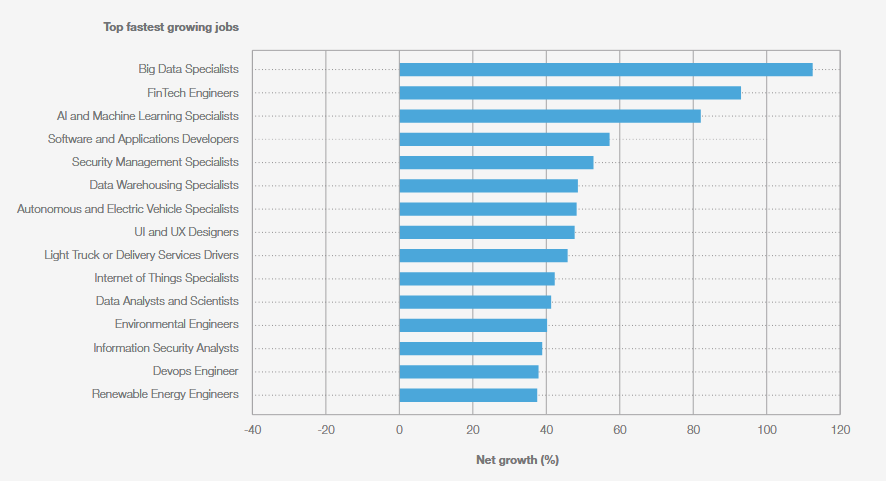

Across industries, employers highlight three themes: analytical thinking, data literacy, and the ability to leverage AI safely. The World Economic Forum’s (WEF) Future of Jobs Report (2025) notes that two-fifths of today’s core job skills will shift by 2030, emphasizing the urgency of continuous upskilling.

Financial Data Analyst Skills That Win Interviews in 2025–2026

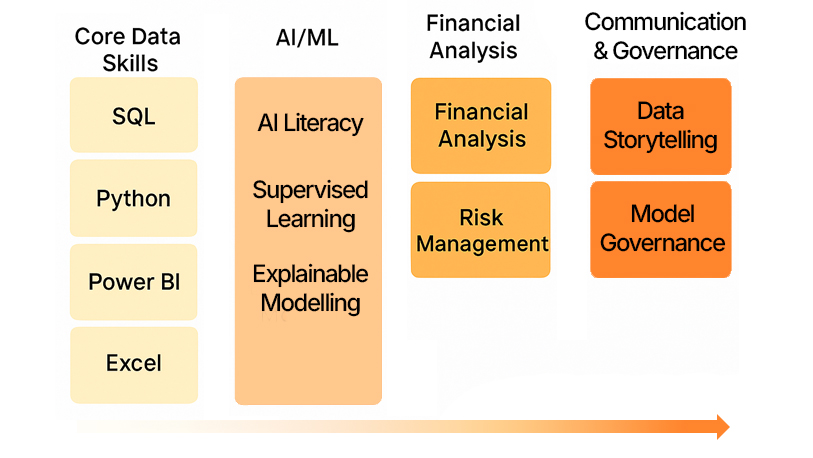

1. Core Data Skills:

- SQL (especially window functions and CTEs)

- Python (pandas, NumPy, scikit-learn)

- Data visualization (Power BI, Tableau),

- Excel / VBA (power use)

Statistics and econometrics remain the foundation for forecasting and hypothesis testing.

2. AI and Machine Learning:

- Supervised learning for credit scoring or churn modeling

- Time-series forecasting (ARIMA, Prophet, Gradient Boosting)

- Explainable AI (SHAP, LIME) for model risk and auditability

Familiarity with GenAI copilots and AI-assisted code generation is quickly becoming a differentiator.

3. Financial Domain Expertise:

- Understanding financial statements

- Ratio analysis

- Risk frameworks (credit, market, liquidity)

- Structure of financial products

The ability to translate data outputs into business insight remains irreplaceable.

Where AI Is Already Delivering Value for Financial Data Analysts

AI is being deployed most actively in fraud detection, portfolio optimization, credit and liquidity risk modeling, and customer analytics. Over 90% of financial institutions report exploring AI for internal automation or customer insight generation.

Financial Data Analysts who can operationalize these models by integrating dashboards, APIs, and explainability layers, are in high demand.

Consulting surveys show that AI’s ROI remains mixed unless paired with clear use cases and governance. This means candidates who combine hands-on technical skills with measurement, validation, and model oversight stand out most.

90-Day Upskilling Plan

Days 0-30: Focus on fundamentals.

Build two small projects: an earnings dashboard (Power BI + SQL) and a credit-risk model (Python + SHAP).

Publish both to Github or Gitlab with documentation (README) and visuals.

Days 31–60: Integrate AI tools.

Use prompt-to-SQL generators, document summarization, and AI-assisted testing.

Measure time savings and improvements in data accuracy.

Days 61-90: Deploy lightweight production workflows.

Containerize notebooks (Docker or Poetry), schedule dbt or SQL jobs, and automate reporting via Quarto or Power BI refreshes.

Add a one-page “model governance” note to demonstrate control and accountability.

Portfolio Project Ideas That Map to Hiring Signals

- Forecasting Pack: Cash flow and revenue projections with scenario toggles (for FP&A roles)

- Anomaly Detection: Credit-card or claims data with SHAP explainability (for Risk/AML)

- Factor Model Mini-Lab: Backtesting size, value, and momentum factors (for Asset Management)

- GenAI Reporting Assistant: Extract MD&A insights from PDF reports and map them to KPIs (for Operations Analytics)

Interested in learning more about anomaly detection? See our article on Federated Learning and applications for anomaly detection.

AI-Augmented Workflow (What “Good” Looks Like)

- Data Intake: Prompt-to-SQL draft → manual review → lineage log

- Exploration: Notebook profiling, anomaly detection, copilot-assisted cleaning

- Modeling: Baseline → tuned model → SHAP/LIME for interpretability

- Narrative & Visualization: AI draft of executive summary → human edit → publish dashboard

- Governance: Automated checks for bias, drift, and access control

Certifications and Learning Paths for Financial Data Analysts

Certifications can validate skills, but projects prove them. Popular credentials include CFA or FRM (for financial rigor), “Machine Learning for Finance” specializations, Microsoft’s Power BI Analyst, and dbt or Snowflake micro-badges. Pair at least one certification with a tangible portfolio artifact.

The IABAC has a financial data scientist certification program that is designed to equip professionals with both the technical expertise and financial knowledge needed to excel in roles like financial data analysts and data scientists.

Resume and Interview Tips

- Lead with impact: “Cut monthly reporting time by 28% using dbt and Power BI.”

- Show AI-in-workflow: “Prompt-to-SQL prototypes reduced ad-hoc turnaround from 2 days to 4 hours.”

- Demonstrate governance: “Introduced model card and bias check for credit model; passed internal audit.”

Conclusion

AI isn’t replacing financial data analysts, it’s redefining what “analysis” means. The most valuable professionals in 2025 will be those who merge financial logic with data automation, who know when to trust a model and when to question it, and who can translate complexity into clarity for decision-makers.

Analytical thinking, data literacy, and responsible AI integration, these are the true currencies of the financial data jobs market in the AI age.

Stay Connected

Want to future-proof your analytics career?

Subscribe or follow Data Sense for insights on AI-driven data careers, dashboard design, and workflow automation. Join our newsletter or upcoming workshop series on “Integrating AI into Financial Analytics” — practical, project-based, and built for professionals who want to stay ahead of the curve.

Sources

- LinkedIn & Indeed job listings (2025)

- Glassdoor compensation data

- World Economic Forum Future of Jobs Report (2025)

- McKinsey & BCG AI adoption surveys

- OECD Skills for the Digital Transition (2022)

- IABAC The Rise of Financial Data Scientists in Modern Finance (2025)